|

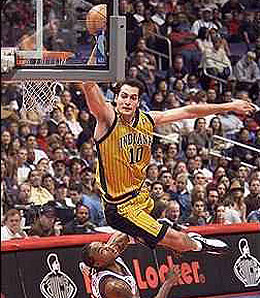

| Jeff Foster, the richest man in the NBA |

However, an article in the recent sports issue of BusinessWeek had me laughing out loud on the airplane (forcing the person in front of me to inquire what I was reading, which quickly started an even funnier conversation about pro basketball players and intelligence).

Before we begin, the NBA is 80 percent Black and only 10 percent white American (the other 10 percent a mixture of European's and Chinese eugenic experiments). Now, the article in BusinessWeek focused on Indiana Pacers - yes, the same club where Larry Bird attempted to re-create the majority white structure of the 1980s Boston Celtics (a team that saved the NBA) - reserve center Jeff Foster and how he is coping financially with the lockout.

For those unaware - or who don't care, like 99 percent of American's - the NBA owners have locked-out the vastly overpaid players.

It is well known that most of the NBA players go bankrupt after they retire (if they don't go around shooting people), which is something the very white Foster will never be accused of doing. Here's the entire article, which you must read to believe:

Early in his National Basketball Assn. career, Jeff Foster, a center for the Indiana Pacers, became acquainted with a man he came to think of as a friend. The man followed the team on road trips and called Foster’s hotel room to invite him for meals. Then one day the man presented Foster with a business opportunity: For just $2 million, the basketball player could be part of a surefire venture to open a bed and breakfast in the verdant Pennsylvania hills. When Foster explained, truthfully, that he didn’t have that kind of money—the Pacers paid him just over $4 million for the first four years of his career, about half of which was gobbled up by taxes, escrow payments, and his agent’s fee—his “friend” was undaunted. He asked Foster to introduce him to an older teammate who had just signed a much more lucrative contract. Foster declined. “And of course,” Foster says, “I never spoke to him again.”

Professional athletes are not generally known for shrewd financial judgment. What was former Notre Dame star player “Rocket” Ismail thinking when he bankrolled a calligraphy business, for example? Did it make sense for ex-NBA guard Latrell Sprewell to turn down a $21 million contract offer late in his career and then buy a yacht? Sports Illustrated estimates that 60 percent of NBA players go broke within five years of retirement and 78 percent of National Football League players “have gone bankrupt or are under financial stress” within two years after they stop playing. (According to NBA Players Assn. spokesman Dan Wasserman, between 6 percent and 8 percent of players end up broke.)

It takes about five seconds to compile a list of once-rich, now-broke sports luminaries: former Boston Celtics All-Star Antoine Walker (gambling habits, huge entourage, multiple luxury cars); New York Jets backup quarterback Mark Brunell (real estate investments in a tanking Florida market); and, perhaps most notoriously, ex-Philadelphia Phillies center fielder Lenny Dykstra (who bought and unsuccessfully tried to flip Wayne Gretzky’s $17 million home, was indicted for bankruptcy fraud, and faces charges of grand theft auto and indecent exposure; Dykstra denies the charges).

Such recklessness typically earns athletes more ridicule than sympathy. And yet for the moment, the ranks of America’s unemployed include pro basketball players: Because of an owner-led lockout, most NBA players, even those under contract, will stop receiving paychecks by the end of October, when the regular season was scheduled to start. Some players are scrambling for backup jobs, with about 15 percent, including standouts such as Deron Williams, signing up to play in overseas leagues in the interim.

For hard-nosed, low-scoring NBA veterans such as Foster, however, hooking up with a foreign team isn’t a viable option. Foster is a free agent, which means he doesn’t know where he’ll be playing next, if at all. At 34, he hasn’t achieved the fame of the league’s stars. Look him up on YouTube (GOOG) and you find this: “Amare Stoudemire dunks Jeff Foster to the ground!” and “Shaquille O’Neal alley-oop dunk over Jeff Foster.” Nonetheless, Foster has played in the NBA for 12 years and earned more than $47 million, and he’s done something extraordinary: He’s saved about three-quarters of his take-home pay. “Jeff’s an example of a pro athlete who’s done it right,” says Doug Raetz, co-founder of True Capital Management, a San Francisco-based wealth management firm that represents Foster and about 150 professional basketball, football, and baseball players.

Foster, who is six-feet-eleven, entered the league with advantages that many of his fellow professional athletes lack. He grew up in an upper-middle-class home—his mother worked as a high school principal in San Antonio, while his father ran a property management company. When he was in 11th grade—the same age as LeBron James when he had his first Sports Illustrated cover—Foster was playing on the junior varsity squad and thinking about becoming a journalist. That focus on another career may ultimately have helped him financially. “In our culture, a top athlete often stops being a student in the seventh grade and the focus is on sports,” says Peter Dunn, a financial adviser who has worked with several Indianapolis Colts players.

When Foster graduated from high school, his relatives gave him $1,000, which he invested in two mutual funds. “I didn’t really need the money for a while,” he said over lunch on Oct. 5 near his home in Carmel, Ind. “I always had an interest in finance, but actually having my own money in the markets took it to another level.”

He enrolled in the first school that offered him an athletic scholarship, Southwest Texas State University (now Texas State University-San Marcos). “My goal was to get a free education,” he says. “I never thought I’d play in the NBA.” Yet he had a strong college career, and the Golden State Warriors selected him with the 21st pick of the 1999 draft, before trading him to the Pacers. His rookie deal of $4.34 million over four years was much less lucrative than those of NBA superstars, but compared with the average American, Foster was rich.

“As I learned in my finance classes in college, when you’re in your twenties you invest heavily in the market, and as you get older, you become a lot less aggressive,” says Foster. His initial forays into investing coincided with the peak of the Internet bubble. “I was extremely aggressive investing early on. I put a lot of money into an Internet fund. I watched it go up about 20 percent in the first couple of months, but then it just vanished.”

This is one of the funniest articles I have ever read. Ever. Jeff Foster isn't Nigga Rich, he's a white boy who in a more civilized time would be a hero to millions. In Black-Run America (BRA), he's an oddity for not being one of the potential destitute former NBA players upon retirement.Foster now considers himself fortunate for having learned an early lesson. By the time he signed his second deal with the Pacers in 2002—six years for $30 million—he had become a much more conservative investor. Today, while he still actively buys and sells stocks, only 13 percent of his portfolio is invested in the stock market. Although Foster and his advisers declined to provide the exact amount of his savings, they did provide a breakdown, by percentage, of his portfolio. The biggest portion—33 percent—is in fixed income, largely municipal bonds. Eleven percent is invested in managed real estate—apartment buildings and student housing that provide Foster with monthly income and tax breaks without the headache of personally overseeing properties and tenants. Eight percent is allotted to private equity; 7 percent is in private investments that aren’t supervised by True Capital Management.

Foster is still richer than these two Black dudes

Foster keeps 28 percent of his savings in cash. He says he normally has 5 percent to 10 percent of his portfolio in cash, “but I’m scared of the market now, though I think at some point there’s going to be an opportunity to invest and get a great return.” Foster and many other players turned down the NBA’s offer to spread out players’ salaries over the course of the lockout. “It’s better to have that money earn interest for you,” Raetz says, adding that the NBA’s offer makes more sense for younger players who haven’t saved much.

Unlike many NBA players, who may have various children, parents, cousins, and friends to support, Foster has only his immediate family to worry about. “Most of our clients are the only real earning source for their extended families,” Raetz says. It isn’t just family expenses that can get athletes in trouble. Former Chicago Bulls All-Star Scottie Pippen’s purchase of a private jet resulted in years of financial hardship and legal battles. Las Vegas casinos accused Antoine Walker of amassing more than $800,000 in gambling debts, while the sports blog Deadspin reported that during Metta World Peace’s (né Ron Artest’s) stint as a member of the Indiana Pacers, he would pay for his house to be recarpeted each month rather than clean up the dog crap that accumulated. (He now plays for the Los Angeles Lakers.) “The stereotype about the spending habits of athletes is largely true,” Raetz says.

After Foster signed his first contract in 1999, he bought a “modest $175,000 cookie-cutter house,” as he puts it, in downtown Indianapolis. Unless you’re a top-five pick, “it’s really not feasible to spend [$100,000] on a car,” Foster says, explaining why his taste isn’t more lavish. He paid for his wedding to his wife, Jamie, whom he met in college. In 2004, two years after he signed his biggest contract, he upgraded to a four-bedroom, seven-bathroom lake house in Noblesville, Ind. (He’s now trying to sell it for $2.6 million.) Foster sends his five-year-old twin daughters to a private school that emphasizes multilingual education. Annual tuition is about $13,500 per student.

“My biggest luxury expense is that I like to travel,” Foster says. “Given my size, when first class is affordable, I buy it. But we just flew coach back and forth to Texas with the kids, and I just put up the armrests and lay across the seats.”

The lockout has created new issues for NBA players, particularly rookies who have yet to see their first paycheck and aren’t playing overseas. “When they walk into a bank to try and get a loan, they’re unemployed,” Raetz of True Capital says. “They haven’t signed their NBA contract yet.” In several cases, Raetz and his business partner, Heather Goodman, have found private sources to secure loans for such clients. They’ve also signed up their NBA players for COBRA extensions on their health insurance, which the league no longer provides to any players.

Foster counts himself among the lucky ones. With the regular season on hold, he is happy to spend time with his family. As a free agent, he would like to sign again with the Pacers and continue to work for the organization when he retires, but his financial well-being doesn’t depend on another contract, he says. When he signed his $30 million, six-year deal in 2002, he told himself: “No matter what else happens, this is enough money to set myself and my family up for life.”

Still, he’s looking to cut costs. After Foster signed his latest contract extension in 2008—two years for $12.73 million—he did indulge in one extravagance, buying himself a $100,000 Porsche. “I wanted to treat myself, because I knew it could be my last big contract,” he says. But then, with the lockout on his mind, he sold it at a $3,000 loss. Now he drives an Infiniti SUV.

Of all the players in the NBA to profile, BusinessWeek must profile a journeyman white center to document sound financial investment strategies.

To paraphrase Harry Bailey from It's a Wonderful Life: a toast, to Jeff Foster, the richest man in the NBA!

33 comments:

HBD FTW!

Friggin' hilarious!

Sports Illustrated estimates that 60 percent of NBA players go broke within five years of retirement and 78 percent of National Football League players “have gone bankrupt or are under financial stress” within two years after they stop playing.

Does anyone want to bet that there is a similar profile with respect to Blacks in professional boxing?

[crickets]

Think: Mike Tyson. This is, perhaps, one of the most absurd things about all the adulation being lavished upon Black Run Sports. When post-retirement productivity is taken into account, just about nowhere are there any substantial Black role models.

It is this incapacity for forward-looking thought that serves as a hallmark regarding the general lack of intelligence in Blacks of any nationality. This common pattern regarding gross mismanagement of funds is a direct reflection of just how corrupt nearly all Black cultures are. One gander at Transparency International's map of global corruption indices confirms this. Here are rankings of African countries ― with some others thrown in for reference ― from the roster of some 178 listings:

1 Denmark

1 New Zealand

1 Singapore (countries can share ranking spots)

17 (Japan)

22 (United States)

32 (Portugal)

33 Botswana

39 Mauritius

45 Cape Verde

49 Seychelles

54 South Africa

56 Namibia

59 Tunisia

62 Ghana

66 Rwanda

69 Montenegro

78 (Communist China)

78 Lesotho

85 Malawi

85 Morocco

87 Liberia

91 Djibouti

91 Gambia

98 Burkina Faso

98 Egypt

101 Zambia

105 Algeria

105 Senegal

110 Benin

116 Ethiopia

116 Mali

116 Mozambique

116 Tanzania

123 Eretria

123 Madagascar

123 Niger

127 Uganda

134 Sierra Leone

134 Zimbabwe

143 Mauritania

146 Cameroon

146 Côte d’Ivoire

146 Libya

154 Comoros

154 Congo-Brazzaville

154 Guinea-Bissau

154 Kenya

154 (Russia – for reference)

164 Democratic Republic of the Congo

164 Guinea

168 Angola

168 Equatorial Guinea

170 Burundi

171 Chad

172 Sudan

178 Somalia (last entry)

As can be seen, African countries take their status as economic hellholes quite seriously and fiercely battle for cellar-dweller spots in the corruption rankings.

Furthermore, it seems as though there is some congenital inability for Black Africans to discard such corrupt behavior upon arriving in the United States. For example, Somalian, along with Nigerian immigrants all figure rather prominently in their local criminal blotters and incarceration statistics.

As a side note, Americans should be proud of their ranking in this list. As the world's largest economy, avoiding the abject corruption of other large powers like ostensibly Democratic Russia and Red China is quite an achievement. Remember, the bigger the pool, the more fish that want to swim in it.

Of all the players in the NBA to profile, BusinessWeek must profile a journeyman white center to document sound financial investment strategies.

Quelle surprise!

Blacks are a degenerate race

a mixture of European's

The whats of Europeans? Their shoelaces?

The plural of "European" is "Europeans". No apostrophe.

like 99 percent of American's

The plural of "American" is constructed by the same rule.

There are some very simple rules you can apply to get this right nearly 100% of the time:

1. The possessive pronouns "his", "hers" and "its" do NOT have apostrophes.

2. The contraction "it's", meaning "it is", DOES have an apostrophe.

3. Plurals such as "Americans" and "cars" do NOT have apostrophes.

4. Possessives, in phrases such as "an American's sense of self", DOES have an apostrophe.

5. The possessive of a plural is constructed with an apostrophe after the s, e.g. "Americans' sense of self"

Now print this out and tape it to your monitor.

Does the name 'Chris Tucker' ring a bell?

Tucker is the actor who co-starred with Jackie Chan in the RUSH HOUR movies.

After the commercial success of the first Rush Hour film, Tucker held out for a $20 million salary for Rush Hour 2 and was paid $25 million salary for Rush Hour 3.

The latter was part of a $40 million two-movie contract with New Line Cinema that also included an unnamed future film. He was also to receive 20% of the gross against his salary from the Rush Hour 3.

It is also reported that Tucker, who is black, filed bankruptcy.

How is it possible that a person who earns over $60 million can go broke? I don't know about you, but I could retire quite well on a fraction of his earnings.

Tucker's $6 million Florida mansion is in foreclosure. He owes $4.4 million to the bank, court papers reveal. His mortgage payment was over $25,000 per month. What's more, the IRS filed an $11.5 million lien on the home.

Google 'chris tucker bankruptcy' for the gory details.

My first point being: It's not just blacksketball players who mishandle money.

A second point to ponder: Showering incompetent people with welfare dollars scammed from mostly White taxpayers will not lift them out of poverty.

I call it 'blacksketball'.

One would think that coming into a large volume of cash in one lump sum could solve (or at the very least reduce) numerous money related problems.

But for athletes it seems that they irrationally presume more will come their way....much more.

Not too different from a college teen with a brand new Visa.

I echo Baldowl's sentiments exactly Paul.

I'm not really interested in sports at all, but I'll be darned if your articles on sports don't intrigue me.

I laugh that Forbes had to cite 2 white athletes (brunell and Dykstra) when citing athletes mihandling money. Can't even appear racist by mentioning the truths that the SI article discussed. I will give SI credit as they discussed how paternity issues, 'too good to be true' pipedream deals, excessive spending, and divorce wreck these guys finances.

That Ron Artest line is disgusting.

At 25 I have more saved and invested than Mike Tyson (a black man who made $20mil per fight) has net worth.

"Tyson, 44, revealed without any shame that he is “totally destitute.” When asked how he got to such a low point, Mike Tyson responded, “I had a lot of fun. It just happened.”" http://www.essence.com/2010/05/11/celebrity-net-worth/

I'm sure, that despite never making more than $42K/year I'm worth more now than many rap stars and athletes out there. But hey, that's what happens when you save 50-100% of every paycheck you've ever made since the age of 14.

[And seriously, I encourage all white folks to impliment similar measures regarding their family budgets. You won't enjoy ten years from now the debts you encur today, nor are you enjoying today the debts you encured ten years ago. I'm not saying don't have anyfun, just be modest and don't go crazy.

Family First! Families that save and accumulate long-term wealth are stable. People who live pay-check-to-pay-check tend to be instable. When something happens instability spikes and so does that stress on the family]

================================

Back to the post.

I especially like what Peter Dunn said regarding education: “In our culture, a top athlete often stops being a student in the seventh grade and the focus is on sports,”

No kidding.

These guys don't know how to NOT blow their savings. Most are no better than African warlords who amass 'wealth' and then distribute it to their "entourages" for (very real) protection or else finance their lavish lifestyles.

This all comes down to something we've talked about time and time again: The black mind's inability to plan for the future.

What sucks is that White kids, not necessarily wiggers, are learning these spending habits now that celebrities, athletes and rap musicians are role models for kids instead of parents. A lot of them are not getting by and this contributes to the erosion of the middle class and the destruction (because they're financially unstable) of the White family.

Clearly folks like Foster are able to plan and are more than comfortable living off of modest amount per year and saving most. The blacks: They just spend it all whether they make 30K a year or 30M. At the end of the day once it stops coming in (assuming no government incentives to be a piece of shit) they're pretty much done for.

OT:

Jeff Foster has actually been a pretty good rebounder/defender for a while now. I wouldn't be surprised to see a team like the Heat or Celtics add him for depth.

Count me as another who has minimal interest in sports (I routinely skim your long football entries), but both the Business Week article and your post were fascinating. Totally aside from the intriguing financial details, the athletes' family difficulties seemed only tangential, but of course are central to their problems. Black athletes or performers routinely have huge entourages, both demonstrating their riches and presumed importance, and costing them millions. They pay for the maintenance of a huge extended family. They either marry another hood rat (who knew them before they were famous) or an extremely high maintenance model/actress. Despite their minimal level of intelligence, education, and culture, they still experience life in a way that causes an increasing rift with those who've only known the hood. They routinely end up with lots of their own welfare baby mammas or a vengeful high yalla wife suing for repeated infidelities.

All of the above applies equally to all politicians, although blacks to a greater degree than Whites.

The funny thing is that some of Mr Fosters investments have been real bummers. Munis? Nigga please!

But just doing the common-sense thing, laying cash aside, no matter in what investment has been sufficient to make him the richest man in the NBA.

Says more about the other players than Mr Foster himself.

Dissident: I'm not really interested in sports at all, but I'll be darned if your articles on sports don't intrigue me.

Speaking as someone who finds watching paint dry more interesting than most televised sports, it is impossible to overstate the importance of why Paul Kersey writes at such length about sports, especially Black dominated sports.

As W74 notes:

What sucks is that White kids, not necessarily wiggers, are learning these spending habits now that celebrities, athletes and rap musicians are role models for kids instead of parents. A lot of them are not getting by and this contributes to the erosion of the middle class and the destruction (because they're financially unstable) of the White family. [emphasis added]

This is no small matter and, knowingly or not, such an inversion of role models propels the demoralization and "immoralization" of American youth.

There is one common denominator that permeates the entire thug life, dystopian culture of Black Run Sports. It is a degenerate and overarching component of what amounts to nothing less than a cultural putsch being directed at White America. This poison is none other than (c)rap "music". No other single entity represents such a huge lever in terms of destabilizing America's societal foundations.

Flying below radar by wearing the Constitutionally protective cloak of "artistic expression", this septic cauldron of hate speech and bowel sounds is actively destroying White culture specifically and civilization in general around the entire world.

Conversely, it is interesting to note that simply playing classical music can drive away vandals, prostitutes, drug dealers and other violent criminals. An intriguing article at SixWise contains some startling statistics and a few genuine revelations concerning this phenomenon:

In 2004 in London, England, the British Transport Police piped classical music into London Underground stations in some of the area’s most dangerous neighborhoods. After playing the music for six months:

● Robberies were cut by 33 percent

● Staff assaults decreased by 25 percent

● Vandalism went down 37 percent

This is not the first time that classical music has been used to deter crime. In 2001, police in West Palm Beach, Florida installed a CD player and speakers on an abandoned building in a crime-ridden neighborhood. After playing classical music — mostly Mozart, Bach and Beethoven — 24 hours a day for about three months, shootings, thefts, loiterers and drug deals decreased. [emphasis added]

(To be continued.)

The article goes on to note something of great significance:

Soothing music like classical, for instance, is known to reduce stress and anxiety. One hospital study even found that heart patients received the same anti-anxiety benefits from listening to 30 minutes of classical music as they did from taking the drug Valium. [emphasis added]

This is very revealing in that modern youth seem almost addicted to "stress and anxiety", most likely due to the adrenaline release and consequent manic disposition that these emotions can induce.

There is also the issue of hypnotic effects caused by repetitive, rhythmic sounds. ELF (Extra Low Frequency), audio sources such a the popular sub-woofer emissions, called "infra-sound", used in (c)rap "music" can also cause disorientation, giddiness and anxiety.

All of these sensations and cognitive influences point towards an almost intentional brainwashing of those who listen to (c)rap "music". This aspect of disrupting common thought processes is only heightened by the fact that very low audio frequencies around 7 Hz (cycles per second) can interfere with median alpha-rhythm frequencies of the brain.

Finally, there is more commonly known concept of "sonic turf". Low frequency audio waves have numerous characteristics that are very invasive. They penetrate materials more easily and often seem to have no easily discernible source. Additionally, extremely low frequencies cannot be blocked by ear plugs as these waveforms bypass our auditory system and physically couple with the body's organs and skeletal structure.

This coupling of sound directly to the body may cause feelings of anxiety due to a lack of cognitive resolution by the person hearing them. In turn, this invasive characteristic can produce sensations of intimidation and pseudo-physical assault.

Small wonder that so much of (c)rap "music" relies heavily upon bass audio effects that have little, if anything, to do with the supposed musical score. They are utilized for the explicit purpose of dominating the aural environment and, quite literally, vandalizing the surrounding "sound-scape".

Given the lower average IQ of Blacks it becomes a small wonder that so many free-spending Black athletes emulate the gangsta mentality and thug life of (c)rappers. There may well be an element of subconscious neural programming going on in less intelligent individuals who constantly expose themselves to this disruptive and, ultimately, destructive source of information.

It is cold consolation that more than a few of these glorified criminals ― more commonly known as (c)rappers ― manage to off each other with their typical penchant for violence. Sadly, just as often they have dragged down thousands of others to their primitive warlord-pimp level before shuffling, or being shuffled, off of this mortal coil.

Franz: Says more about the other players than Mr Foster himself.

Which I would boldly venture is the entire point of Paul Kersey's article.

I continue to be amazed at how so many otherwise relatively intelligent individuals here at SBPDL cannot see through the gauze of sports to the more important central issue of Black Run America and its ultimately destructive influence on everyone involved, Whites and Blacks alike.

This white basketball player should be OCCUPIED! It is unfair that he lives comfortably while his comrades on the team suffer financial injustice due to the color of their skin!

Then there's this:

Study finds median wealth for single black women at $5

We read:

Women of all races bring home less income and own fewer assets, on average, than men of the same race, but for single black women the disparities are so overwhelmingly great that even in their prime working years their median wealth amounts to only $5.

Among the most startling revelations in the wealth data is that while single white women in the prime of their working years (ages 36 to 49) have a median wealth of $42,600 (still only 61 percent of their single white male counterparts), the median wealth for single black women is only $5.

Read more: http://www.post-gazette.com/pg/10068/1041225-84.stm#ixzz1cxnJSs4Z

"The biggest portion—33 percent—is in fixed income, largely municipal bonds."

Ouch

“but I’m scared of the market now, though I think at some point there’s going to be an opportunity to invest and get a great return.”

Of course Europe eventually recovered from the dark ages.

I think the Big Tymers summed it up quite well when they said:

Can't pay my rent, cause all my money's spent

but thats OK, cause I'm still fly

got a quarter tank gas in my new E-class

But that's alright cause I'm gon' ride

got everything in my moma's name

but I'm hood rich da dada dada da

And big props to anyone who can take the theme song to Gilligan's Island and make a rap song out of it.

Rev. Dr,. Swift: And big props to anyone who can take the theme song to Gilligan's Island and make a rap song out of it.

Well, it's not exactly (c)rap, but is sure as hell is set to the Gilligan's Island theme song:

(With apologies to George Wyle and Sherwood Schwartz)

(Sung to the tune of "The Ballad of Gilligan's Isle")

Now sit right back, and you'll hear a tale,

a tale of a huge death cult.

That started in the Middle East

with a pedophilic dolt

The prophet was a savage thug,

his followers washed with sand

They left a trail of blood and death

across the Holy Land, across the Holy Land.

The Christians started getting rough

Jerusalem was lost

Knights Templar took al Aqsa Mosque

El Cid, the Moors he tossed

A tent was pitched on the edge of an unconquered Bedouin pile

With Mohammad

His dozen wives

A camel and a knife

A moon and star

A prayer rug and his Qu'ran

That's what makes Islam so vile

So this is the tale of the Musselmen,

they've warred for a long, long time.

They've made the very worst of things,

they've got an uphill climb.

The imams and the mullahs too,

will do their very best

To make Infidels uncomfortable

and war upon the West

No phone, no lights no motor cars,

They've not invented shit

They wipe their butts with rocks instead

Then beat their wives a bit

For a caliphate, jihad they wage

Like Nazis they sieg heil

We'll nuke them back to the stone-age,

because Islam's so vile.

― by Zenster ―

My mother used to say, "Put a beggar on horseback & he'll ride to hell." I don't really remember how old I was before I actually understood what that pithy little saying meant. Sometimes, my mom would simply sigh & say, "Put a beggar on horseback...." while shaking her head over the stupidity of some person she'd read about, who was rolling in dough, living the high life, & usually ruining themselves. It gets me to thinking: can you really blame wealthy people for wanting to marry other wealthy people?

Zenster: Hmmm, be careful with such zionist propaganda around the alt-right, or you may be shouted down as a JOOOOO or neo-con Amerikkkan imperialist pig-dog.

And that won't help the poor brothers in the NBA stop going broke because of whitey!

mama would say:

if wishes were Horses beggars would

ride.

Anonymous (November 6, 2011 9:52 PM): … can you really blame wealthy people for wanting to marry other wealthy people?

Perhaps not, but then again, that sort of thinking is what provided us with inveterate wankers like Prince "I-Want-To-Live-In-Your-Trousers" Charles.

Rev. Dr,. Swift: Hmmm, be careful with such zionist propaganda around the alt-right, or you may be shouted down as a JOOOOO or neo-con Amerikkkan imperialist pig-dog.

Is that all you can come up with? Hell, I've been called worse things by my own family.

And that won't help the poor brothers in the NBA stop going broke because of whitey!

The bad news is that nothing will stop those "poor brothers in the NBA stop going broke because of whitey".

The good news is that nothing will stop those "poor brothers in the NBA stop going broke because of whitey".

Most diseased of all is how so many Black youth have nothing but Black sports celebrities to emulate and, from all outward appearances, they emulate them all the way to the poorhouse. Some role models.

If a bunch of overspending, silked up, tattoo covered, dreadlocked wannabe gangster pimps is all that Black youth have to look up to, they are doomed from the get-go.

Smart fellow, he should buy south american property or someplace. I would, this place is moving too fast for me, I hate to see the future. More cities are falling into the toilet category with no signs of letting up. At least not in my lifetime.

@Bladowl: Ironic? Ain't that one of those things you smooth your clothes out with?

"Those monkey ball players...they just endorse those huge checks with their illiterate X's and they spend it fast and stupid!"

Marge Schott (as voiced by Billy West--words by Jackie "the Joke Man" Martling on the Howard Stern Show 1995). Back when the Stern Show was un-pc.

"Foster sends his five-year-old twin daughters to a private school that emphasizes multilingual education. "

HAH! Now that is thinking ahead!

I am thinking one better: a private school that emphasizes multilingual education and marksmanship.

"It is this incapacity for forward-looking thought that serves as a hallmark regarding the general lack of intelligence in Blacks of any nationality. This common pattern regarding gross mismanagement of funds is a direct reflection of just how corrupt nearly all Black cultures are. One gander at Transparency International's map of global corruption indices confirms this. Here are rankings of African countries ― with some others thrown in for reference ― from the roster of some 178 listings:

1 Denmark

1 New Zealand

1 Singapore (countries can share ranking spots)

17 (Japan)

22 (United States)

32 (Portugal)"

----

You post shows something else though: that some countries suffer from forward-overthinking. New Zealand and Denmark are perfect examples: Far left, (everything about NZ I have heard makes it sound like a massive San Francisco) environmentalist, (remember the Copenhagen summit on "global warming", covered in six-feet of snow?), and reverent to every minority. They are liberals who think toward the future based on their warped, demented view of the present.

Note that most of Russia's infrastructure is Soviet-relic, and corruption is really the quickest way of getting things done.

Furthermore, the rampant corruption of the USA is so well-done that it isn't called corruption. Look at AIPAC and Israel, look at ACORN's descendants and the Democrat Party, look at the Wall-Street men backing both sides of every big election so those in their debt always win. American corruption is so brilliant it isn't even called corruption anymore.

Of course, who always loses any corrupt society? The middle-classes: and here, that means white-Americans.

Post a Comment